Irs Schedule C Form 2024

Irs Schedule C Form 2024 – Some gifts that a small business owner gives to their employees may be taxable, while others are not. Here’s how to know the difference and understand record-keeping requirements and best practices. . For 2024, the maximum HSA contribution for somebody with self-only The HSA catch-up contribution limit for people age 55 and over is not inflation adjusted, so it remains at $1,000. 0% tax rate if .

Irs Schedule C Form 2024

Source : carta.com

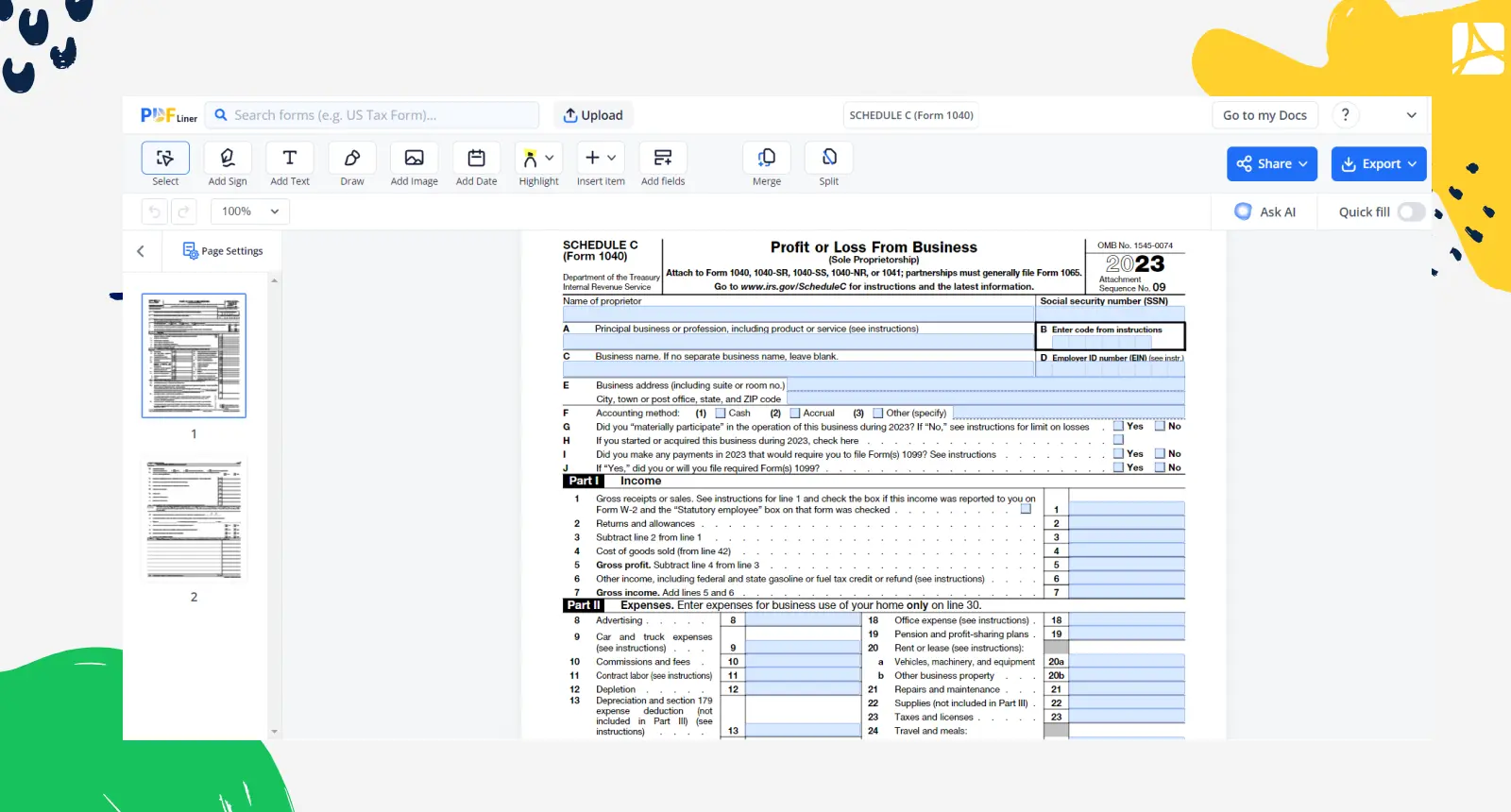

Taxes Schedule C Form 1040 (2023 2024) | PDFliner

Source : pdfliner.com

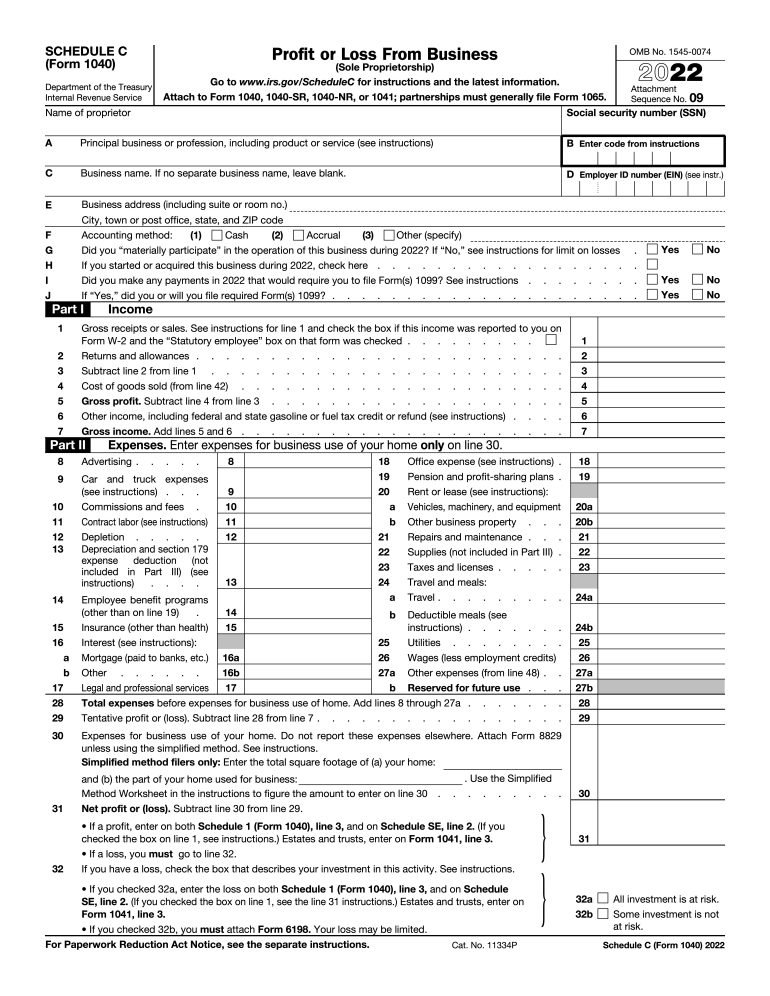

What Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.com

FACTS Flyer 2023 2024 Padua Franciscan High School

Source : paduafranciscan.com

Form 1040 for IRS 2023 2024 ~ What is it? Schedule A B C D

Source : www.incometaxgujarat.org

What Is a Schedule C IRS form? TurboTax Tax Tips & Videos

Source : turbotax.intuit.com

IRS Schedule C Walkthrough (Profit or Loss from Business) YouTube

Source : m.youtube.com

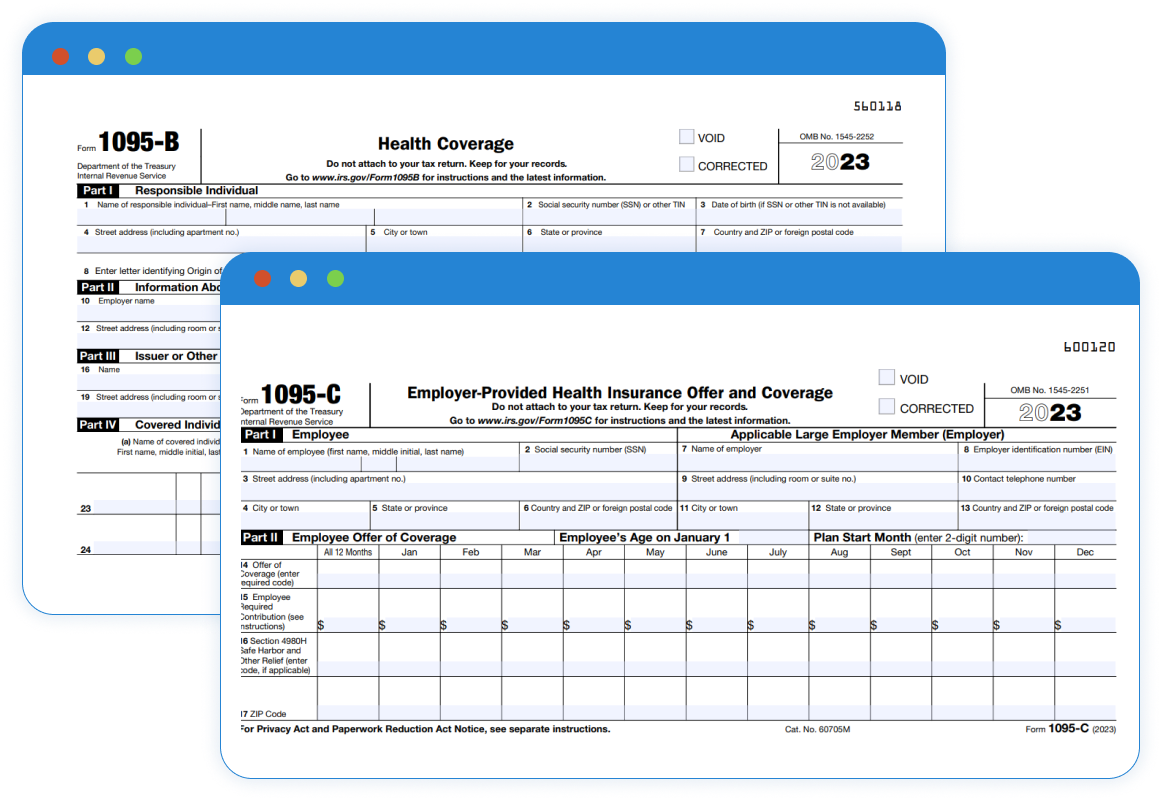

The IRS Releases Final Version of Form 1095 B & 1095 C for 2023

Source : www.acawise.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Schedule C 1040 line 31 Self employed tax MAGI instructions home

Source : individuals.healthreformquotes.com

Irs Schedule C Form 2024 Business tax deadlines 2024: Corporations and LLCs | Carta: Taxpayers will also have higher standard deductions in the 2024 tax year. It increases to $12,950 for single taxpayers and $29,200 for married couples. Unable to view our graphics? Click here to . You do so on a tax form called Schedule C. See Insider’s picks for the best tax software >> Here’s what to know about Schedule C and its filing requirements. Schedule C is a form that self .